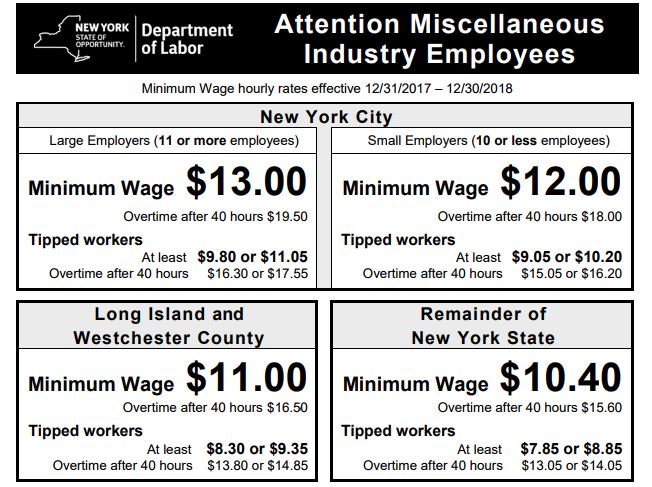

Effective December 31, 2017, the minimum wage in New York City increased to the following rates:

Tax cut for the middle-class

Under the administration of Gov. Cuomo, the middle-class New Yorkers continue to experience reduction in state taxes to record low. The governor’s office estimated that the lower tax rates will benefit six million middle-class taxpayers by 2025.

This 2018, New York City taxpayers will see an average state tax cut of $235. In 2025, they will enjoy an average tax cut of $653.

Paid family leave

Starting on January 1, 2018, the state government will implement its new paid family leave policy.

Workesr who will be eligible for paid family include:

- Parents during the first 12 months following birth, adoption, or foster placement of a child;

- Caretakers for a sick spouse, domestic partner, child, stepchild, parent, stepparent, parent-in-law, grandparent or grandchild;

- Employees with a spouse, child, domestic partner or parent who has been notified of an order of active military service abroad.

Additionally, full-time employees with a regular schedule of 20 or more hours per week will be able to take paid family leave after 26 consecutive weeks of employment.