Kelly Warner Law Firm Blames USA Herald for Arizona Bar Investigation

5/17/17 Based on the information released in The Washington Post article on 5/17/17, the USA Herald publishes another in-depth article that…

By – USA HeraldAaron Kelly Law Firm Resorts To Attacking Former Client Again On KellyWarnerLaw.com – Pattern Recognized

Professor Volokh thereafter filed a bar complaint against Dan Warner with the Arizona Bar. This eventually led the ABA to…

By – Jeff WattersonArizona Bar Opens Investigation on Attorney Aaron Kelly

Volokh, as part of his investigative work, had a private investigator research the defendants in some of theallegedly fraudulent…

By – Paul O'NealUS Draft AI Chip Sales Rules Could Reshape Global Tech Power Balance

A Shift Away From Biden’s AI Strategy The new approach marks the administration’s most significant move toward a global semiconductor…

By – Rachel MooreSix Flags Amusement Parks Sale Signals Major Shake-Up in Theme Park Industry

Clues From Trademark Filings Earlier signals of the shift surfaced in January 2025, when trademark filings reviewed by PEOPLE revealed…

By – Rachel MooreVast $500M Funding Fuels Race to Build the Next Generation of Space Stations

Roadmap to a Commercial Space Station Vast is targeting several major milestones in the coming years. The company plans to…

By – Rihem AkkoucheAlexander Brothers Sex-Trafficking Trial Heads to Jury After Dramatic Closing Arguments

Prosecutors: Pattern of Abuse Spanning Years Federal prosecutors rejected those arguments forcefully during rebuttal. Assistant U.S. attorney Elizabeth Espinosa told…

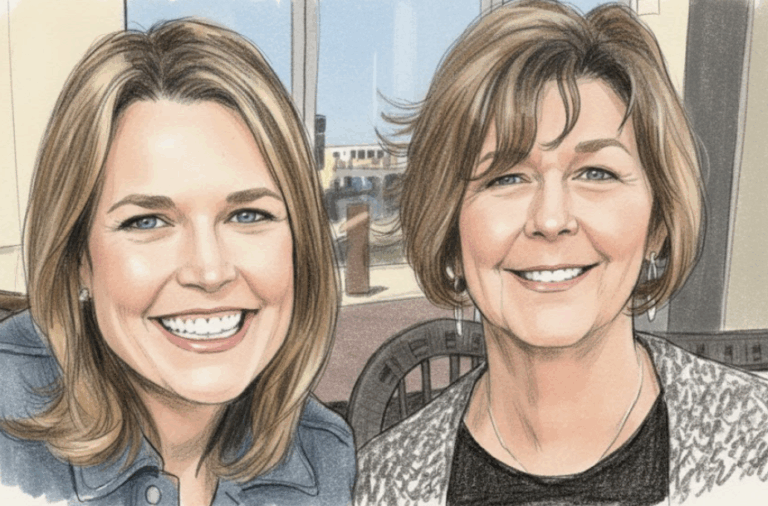

By – Rihem AkkoucheSavannah Guthrie Return to NBC Planned Amid Ongoing Search for Missing Mother

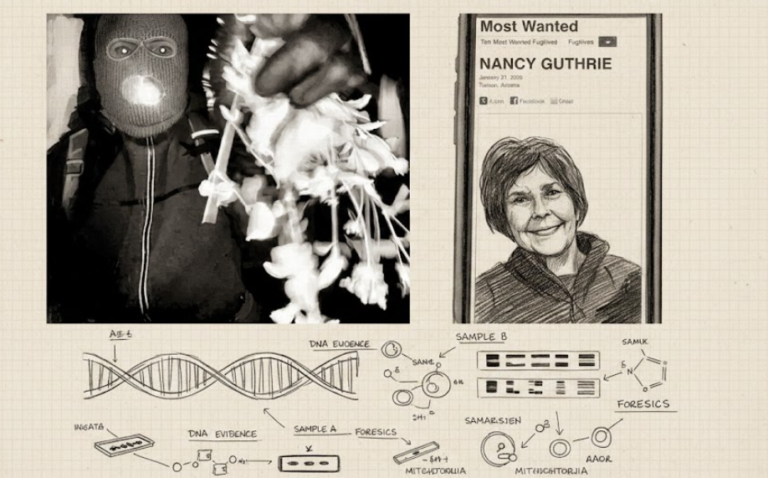

Evidence Found — But No Match In another twist, investigators recovered DNA evidence from a glove found near Nancy Guthrie’s…

By – Rihem AkkoucheSupreme Court Ruling on Tariff Refunds Sparks Major Legal Push by Businesses

Political Pressure Mounts The legal maneuvering is unfolding against a backdrop of rising political tensions. Sen. Elizabeth Warren blasted the…

By – Rihem AkkoucheUS Draft AI Chip Sales Rules Could Reshape Global Tech Power Balance

A Shift Away From Biden’s AI Strategy The new approach marks the administration’s most significant move toward a global semiconductor…

By – Rachel MooreSix Flags Amusement Parks Sale Signals Major Shake-Up in Theme Park Industry

Clues From Trademark Filings Earlier signals of the shift surfaced in January 2025, when trademark filings reviewed by PEOPLE revealed…

By – Rachel MooreVast $500M Funding Fuels Race to Build the Next Generation of Space Stations

Roadmap to a Commercial Space Station Vast is targeting several major milestones in the coming years. The company plans to…

By – Rihem AkkoucheAlexander Brothers Sex-Trafficking Trial Heads to Jury After Dramatic Closing Arguments

Prosecutors: Pattern of Abuse Spanning Years Federal prosecutors rejected those arguments forcefully during rebuttal. Assistant U.S. attorney Elizabeth Espinosa told…

By – Rihem AkkoucheSavannah Guthrie Return to NBC Planned Amid Ongoing Search for Missing Mother

Evidence Found — But No Match In another twist, investigators recovered DNA evidence from a glove found near Nancy Guthrie’s…

By – Rihem AkkoucheSupreme Court Ruling on Tariff Refunds Sparks Major Legal Push by Businesses

Political Pressure Mounts The legal maneuvering is unfolding against a backdrop of rising political tensions. Sen. Elizabeth Warren blasted the…

By – Rihem AkkoucheUS Draft AI Chip Sales Rules Could Reshape Global Tech Power Balance

A Shift Away From Biden’s AI Strategy The new approach marks the administration’s most significant move toward a global semiconductor…

By – Rachel MooreSix Flags Amusement Parks Sale Signals Major Shake-Up in Theme Park Industry

Clues From Trademark Filings Earlier signals of the shift surfaced in January 2025, when trademark filings reviewed by PEOPLE revealed…

By – Rachel MooreVast $500M Funding Fuels Race to Build the Next Generation of Space Stations

Roadmap to a Commercial Space Station Vast is targeting several major milestones in the coming years. The company plans to…

By – Rihem AkkoucheAlexander Brothers Sex-Trafficking Trial Heads to Jury After Dramatic Closing Arguments

Prosecutors: Pattern of Abuse Spanning Years Federal prosecutors rejected those arguments forcefully during rebuttal. Assistant U.S. attorney Elizabeth Espinosa told…

By – Rihem AkkoucheSavannah Guthrie Return to NBC Planned Amid Ongoing Search for Missing Mother

Evidence Found — But No Match In another twist, investigators recovered DNA evidence from a glove found near Nancy Guthrie’s…

By – Rihem AkkoucheSupreme Court Ruling on Tariff Refunds Sparks Major Legal Push by Businesses

Political Pressure Mounts The legal maneuvering is unfolding against a backdrop of rising political tensions. Sen. Elizabeth Warren blasted the…

By – Rihem AkkoucheU.S. And Israel Launch Major Strikes On Iran — What It Means For America

Continuation of military strikes if Iran persists in retaliatory attacks. Diplomacy or ceasefire negotiations if international pressure increases. A broader…

By – Samuel LopezU.S. Court of Appeals for the Ninth Circuit Overturns $8M Asbestos Verdict Against BNSF Railway Co.

BNSF declined to comment on the decision. Judges Consuelo M. Callahan, Morgan B. Christen and Andrew D. Hurwitz sat on…

By – Tyler BrooksMissing DNA Evidence May Limit Investigation Into Nancy Guthrie Case, Sources Suggest

Representatives from FamilyTreeDNA emphasized that the company operates under strict privacy standards and does not directly conduct investigative work for…

By – Ahmed BoughallebGrand Theft Auto 6 Targets November 2026 Launch as Price Leak Fuels $100 Debate

Underwater exploration is also expected to play a larger role, supported by new tools and environmental systems designed to enhance…

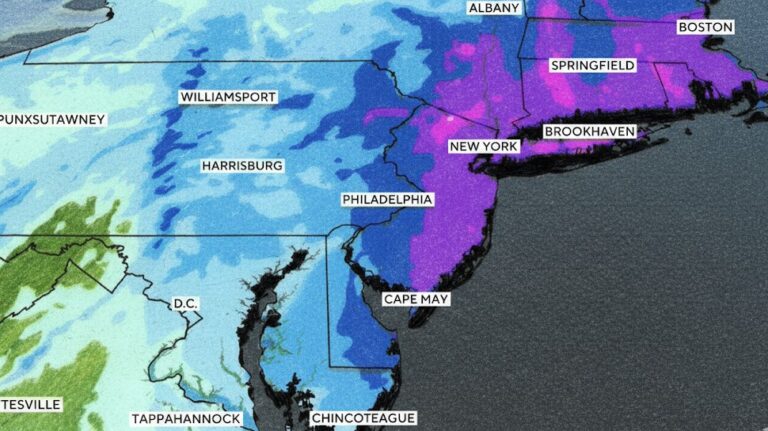

By – Ahmed Boughalleb40 Million Under Blizzard Warnings as Major Winter Storm Threatens U.S. East Coast

“This will be something the likes of which we have not seen in years,” Hochul said. She warned that residents…

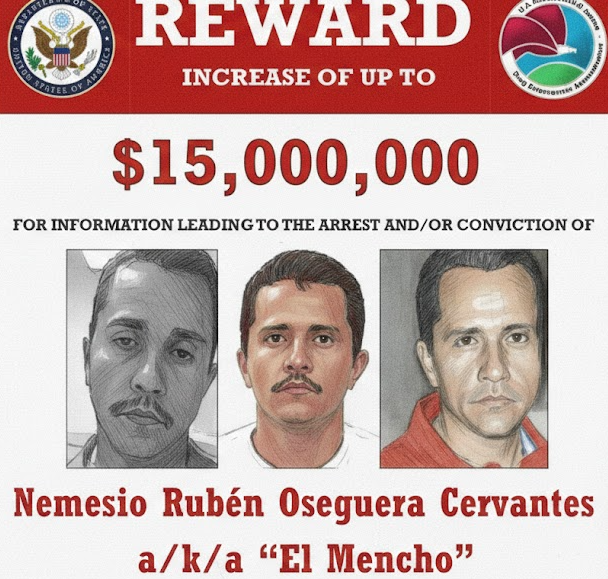

By – Tyler BrooksViolence Erupts Across Mexico After Cartel Leader “El Mencho” Killed in Military Raid, Triggering Roadblocks, Transport Disruptions, and Security Alert Across Several States

Several airlines adjusted schedules due to the security situation. Air Canada suspended flights to Puerto Vallarta because of ongoing safety…

By – Ahmed BoughallebUS Draft AI Chip Sales Rules Could Reshape Global Tech Power Balance

A Shift Away From Biden’s AI Strategy The new approach marks the administration’s most significant move toward a global semiconductor…

By – Rachel MooreSix Flags Amusement Parks Sale Signals Major Shake-Up in Theme Park Industry

Clues From Trademark Filings Earlier signals of the shift surfaced in January 2025, when trademark filings reviewed by PEOPLE revealed…

By – Rachel MooreVast $500M Funding Fuels Race to Build the Next Generation of Space Stations

Roadmap to a Commercial Space Station Vast is targeting several major milestones in the coming years. The company plans to…

By – Rihem AkkoucheAlexander Brothers Sex-Trafficking Trial Heads to Jury After Dramatic Closing Arguments

Prosecutors: Pattern of Abuse Spanning Years Federal prosecutors rejected those arguments forcefully during rebuttal. Assistant U.S. attorney Elizabeth Espinosa told…

By – Rihem AkkoucheSavannah Guthrie Return to NBC Planned Amid Ongoing Search for Missing Mother

Evidence Found — But No Match In another twist, investigators recovered DNA evidence from a glove found near Nancy Guthrie’s…

By – Rihem AkkoucheSupreme Court Ruling on Tariff Refunds Sparks Major Legal Push by Businesses

Political Pressure Mounts The legal maneuvering is unfolding against a backdrop of rising political tensions. Sen. Elizabeth Warren blasted the…

By – Rihem AkkoucheWhen The Files Are Finally Unsealed The Most Mind-Bending Truth May Not Be What We Expect

[USA HERALD] – There is a widespread assumption that if governments release their most highly classified files related to unidentified…

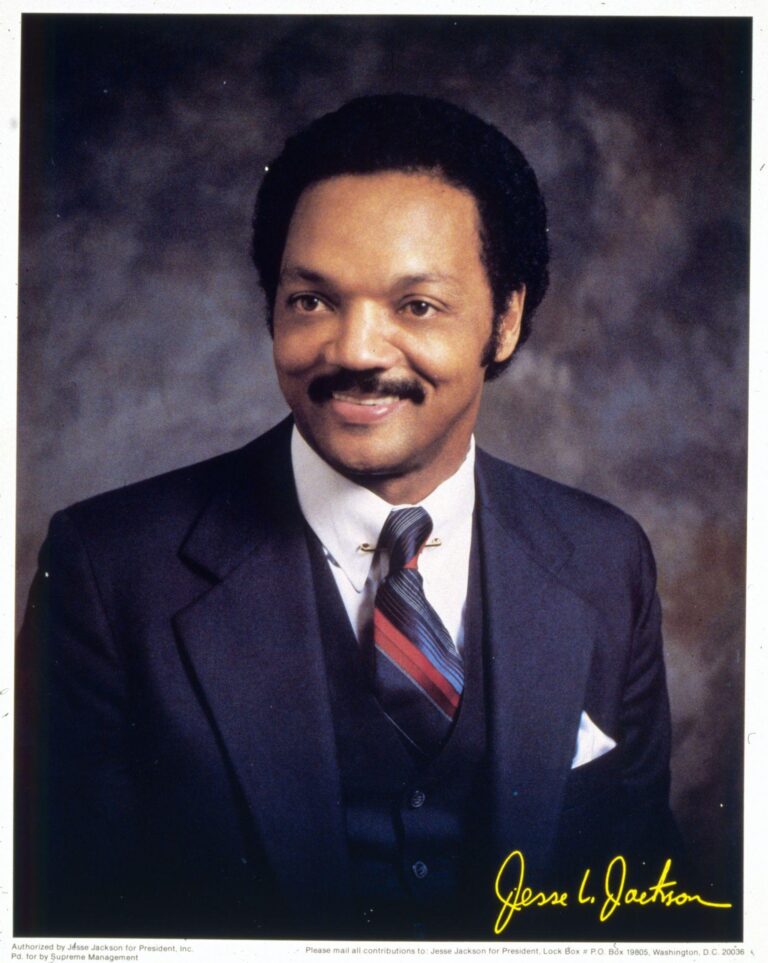

By – Samuel LopezCivil Rights Icon Rev. Jesse Jackson Dies at 84 As President Trump Issues Personal Tribute

Domestically, he applied sustained pressure on corporations to diversify their leadership ranks and invest in minority communities. He publicly challenged…

By – Samuel LopezClues to Savannah Guthrie Missing Mom’s Disappearance Found on Security System

Savannah Guthrie Concerned about Ongoing Investigation With the case entering its second week, investigators remain focused on integrating physical evidence…

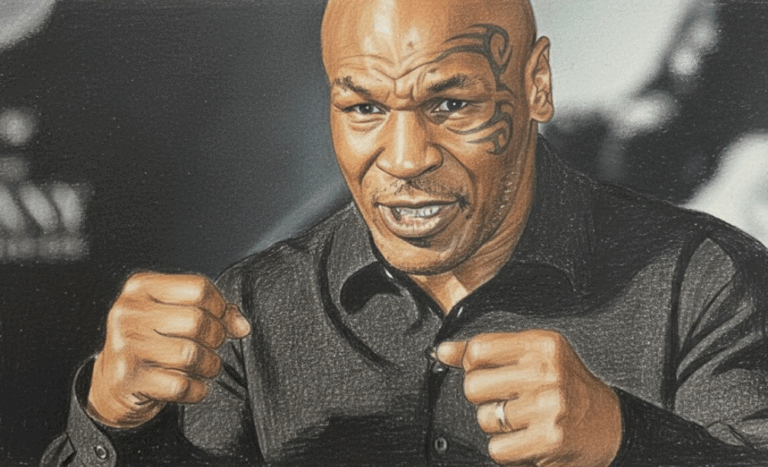

By – Jackie AllenMike Tyson Urges Americans to ‘Eat Real Food’ in Emotional Super Bowl Ad Highlighting Health Risks

Boxing legend Mike Tyson is using his platform ahead of Super Bowl 60 to address a personal and national health…

By – Tyler BrooksDeadly “Death Cap” Mushrooms in California Cause Multiple Deaths and Liver Transplants Amid Rare Super Bloom

California health officials are warning the public after four deaths and three liver transplants linked to the highly toxic death…

By – Ahmed BoughallebFrom Migraines to Miracles: How Becca Valle Survived a Glioblastoma Diagnosis Against the Odds

Becca Valle, 41, thought her headaches were just migraines—until a sudden, unbearable pain revealed something far more serious. In September…

By – Tyler BrooksCadillac Names Inaugural Formula 1 Car MAC-26 in Tribute to Mario Andretti Ahead of 2026 Australian Grand Prix Debut

That persistence ultimately paid off, culminating in the green light for Cadillac’s 2026 entry. Leadership and Vision Team principal Graeme…

By – Ahmed BoughallebNorway Tops Medal Table After Day 13 at 2026 Winter Olympics as Team USA Surges Into Second Place

Upcoming Medal Events Medal competition continues Friday, February 20, with several key finals scheduled. Events awarding medals include: Women’s ski…

By – Ahmed BoughallebOlympic Science Explained: How Figure Skaters Spin at Blinding Speeds Without Getting Dizzy

By – Tyler Brooks

Olympic Villages Run Out of Condoms at 2026 Milan-Cortina Games

Condom supplies in the Olympic Villages at the 2026 Winter Games have been temporarily depleted, the Milan-Cortina organizing committee confirmed,…

By – Tyler BrooksArizona Authorities Escalate Search for Savannah Guthrie’s Mom to a Criminal Investigation

USA TODAY’s live coverage: https://www.usatoday.com Pima County Sheriff’s Office: https://www.pimasheriff.org NBC News reporting: https://www.nbcnews.com As the investigation continues, officials say…

By – Jackie AllenWhat is Aegosexuality?

This early classification, however, sparked significant criticism. Advocates argue that placing aegosexuality in this category not only misunderstood the experience…

By – Jackie AllenNo posts found.

No posts found.

No comments yet. Be the first to comment!

No comments yet. Be the first to comment!