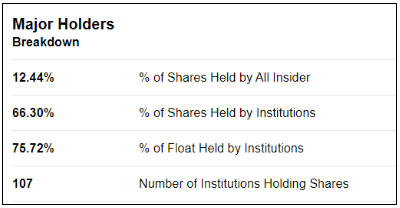

*Data from Yahoo Finance as of 4/5/19

It isn’t just that a significant amount of shares are held by insiders, it’s that these insiders are acquiring more and more shares by the day. In the last 12 months, UPWK insiders have bought over 87 million shares of the stock while selling only 2 million. Some of these acquisitions were automatically triggered to early funders of the company, while others were part of incentive packages to company directors. Whatever the case may be, the shares which have been distributed to insiders over the past year have been held by these insiders, a sign that these people with insight on the company expect positive returns from UpWork in the coming years.

Don’t be fooled by a large investor sale

The SEC recently released a document highlighting a large sale of UPWK stock. On the surface, this could look bad for investors and show a sign that there is a perceived weakness at UpWork. But you have to dig deeper to understand why this isn’t what it seems.

The seller of these shares, Globespan Capital Partners, is a venture capital firm which was an early investor in UpWork. In fact, the fund invested way back in UpWork’s Series A financing round in 2006 where the company at the time raised $6 million. This makes Globespan one of the original UpWork investors, believing in the company’s business model since before they were showing any signs of large scale growth.