Hormuz Shock Hits U.S. Legal And Insurance Sectors As War Risk, Cargo Claims And Contract Fights Begin to Spread

By Samuel A. Lopez | USA Herald – The developing Strait of Hormuz crisis is no longer just an energy-market…

By – Samuel LopezBeyond Gas Prices The Strait of Hormuz Crisis Could Hit Fertilizer, Plastics, Aluminum And Global Supply Chains

By Samuel Lopez | USA Herald – Right now, most Americans hearing about the Strait of Hormuz are thinking about…

By – Samuel LopezFani Willis Blocked From Trump Fee Fight As Georgia Judge Lets $16.8 Million Reimbursement Battle Move Forward

INSIDE THIS REPORT A Georgia judge has ruled that Fulton County District Attorney Fani Willis cannot re-enter the collapsed Trump…

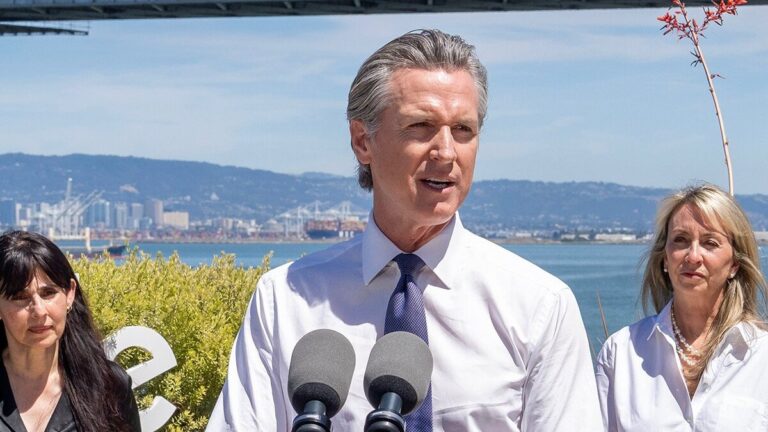

By – Samuel LopezFBI Bulletin Raises Troubling Questions About California’s Readiness

[USA HERALD] – A leaked FBI bulletin has now forced an uncomfortable question into the open along California’s coast. If…

By – Samuel LopezCumulus Media Files for Chapter 11 as Radio Giant Moves to Cut Massive Debt

In a dramatic turn for one of America’s largest radio broadcasters, Cumulus Media has filed for bankruptcy protection, seeking a…

By – Rihem AkkoucheGordie Howe Bridge Tolls Revealed Ahead of Spring Opening

The long-awaited Gordie Howe International Bridge is inching closer to welcoming travelers, and officials have finally unveiled a key piece…

By – Rihem AkkoucheGordie Howe Bridge Tolls Revealed Ahead of Spring Opening

The long-awaited Gordie Howe International Bridge is inching closer to welcoming travelers, and officials have finally unveiled a key piece…

By – Rihem AkkoucheNasa Satellite to Crash to Earth as Spacecraft Re-enters Atmosphere

A Nasa satellite to crash to Earth has prompted warnings from space officials, who say debris from the aging spacecraft…

By – Rachel MooreLux Aeterna $10M Seed Funding Fuels Ambitious Reusable Satellite Vision

A Colorado startup aiming to change how satellites operate — and survive — in space has secured fresh investment to…

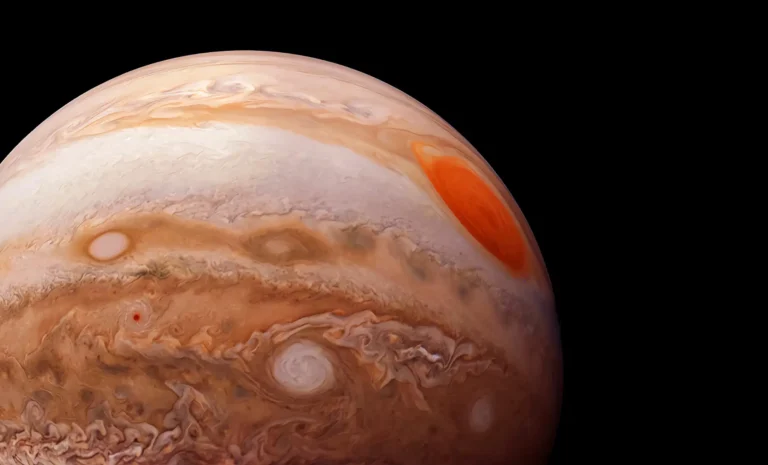

By – Rachel MooreJupiter’s Shift Direction Lights Up the Night Sky Again

Skywatchers may notice something unusual unfolding overhead this week as Jupiter’s shift direction brings an end to months of celestial…

By – Rachel MooreGoogle and Tesla Power Grid Initiative Targets Lower Energy Costs

Two of the world’s most influential technology companies are stepping into the energy policy arena, launching a campaign they say…

By – Rachel MooreMedtronic to Buy Scientia Vascular in $550 Million Neurovascular Deal

In a move poised to reshape the future of stroke treatment technology, Medtronic to buy Scientia Vascular marks a major…

By – Rachel MooreMedtronic to Buy Scientia Vascular in $550 Million Neurovascular Deal

In a move poised to reshape the future of stroke treatment technology, Medtronic to buy Scientia Vascular marks a major…

By – Rachel MooreWinklevoss Twins’ Bitcoin Transfer Sparks Market Speculation

A wave of cryptocurrency movement tied to the founders of the Gemini exchange is drawing fresh attention across the digital…

By – Rihem AkkoucheAlabama Man Fatal Shooting Death Sentence Commuted by Governor

In a rare act of clemency that halted an imminent execution, the Alabama man fatal shooting death sentence tied to…

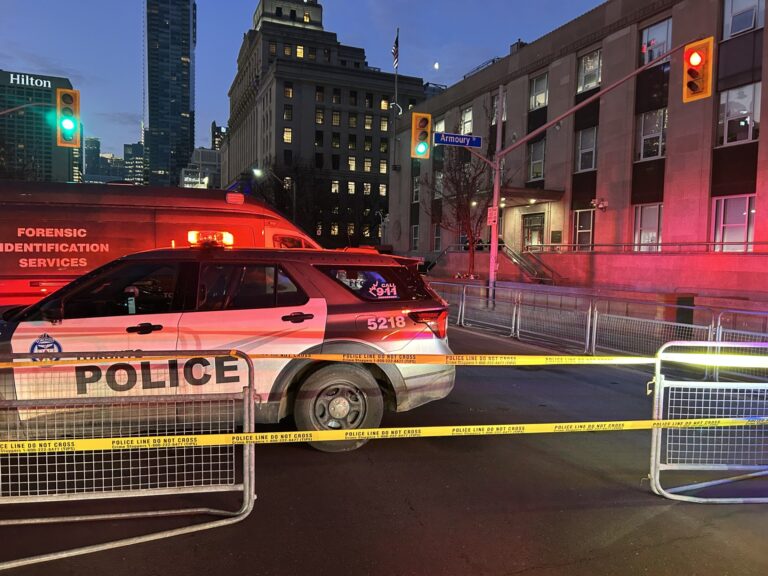

By – Rihem AkkoucheUS Consulate Shooting in Toronto Triggers National Security Investigation

Authorities in Canada are investigating the US consulate shooting in Toronto after gunfire struck the diplomatic building early Monday morning…

By – Rihem AkkoucheExxonMobil to Move to Texas in Historic Corporate Shift

In a move that could reshape the corporate map of one of America’s most powerful energy companies, ExxonMobil to move…

By – Rihem AkkoucheRhoda AI Secures $450M Funding to Power Next-Gen Industrial Robots

In a move set to electrify the robotics industry, Rhoda AI $450M funding marks one of the largest early-stage investments…

By – Rihem AkkoucheTrump’s Laser Talk Sparks New Questions About America’s Secret Arsenal

President Donald Trump has once again done what he often does best in moments of war and tension: he dropped…

By – Samuel LopezThe Northern Lights Return

The Northern Lights have a chance to be visible from several northern U.S. states on Tuesday night, forecasters at the…

By – Jackie AllenFebruary Unemployment Up as Job Losses Surprise Economists

February Unemployment Up as the latest labor market data revealed weaker-than-expected job growth and a slight increase in the national…

By – Jackie AllenLate-Night Attack by Venezuelan National at Florida Beach

A Late-night attack by a Venezuelan National has left a Florida community shaken after authorities say a 26-year-old man ambushed…

By – Jackie AllenTrump’s War in Iran: Congress Confronts Escalation After U.S. Strikes

Trump’s War in Iran was triggered open conflict, casualties, and renewed constitutional debate in Washington. The crisis intensified following reports…

By – Jackie AllenU.S. And Israel Launch Major Strikes On Iran — What It Means For America

TEHRAN, Iran – In a dramatic escalation of global tensions, the United States and Israel launched coordinated military strikes against Iran…

By – Samuel LopezRhoda AI Secures $450M Funding to Power Next-Gen Industrial Robots

In a move set to electrify the robotics industry, Rhoda AI $450M funding marks one of the largest early-stage investments…

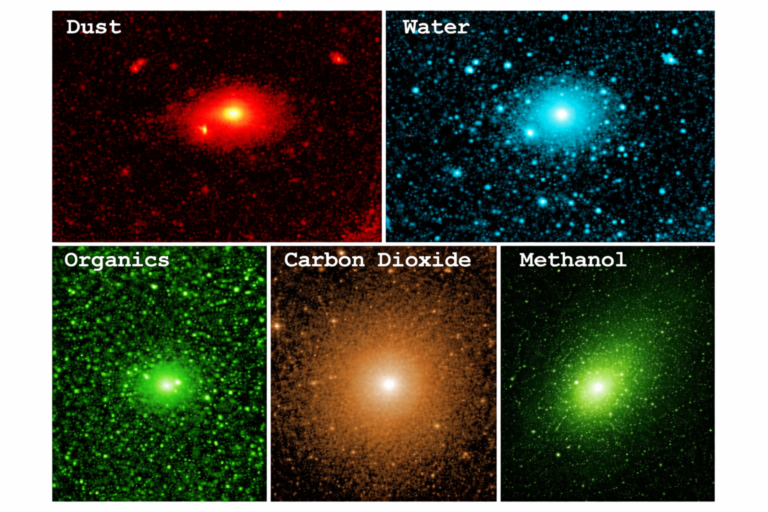

By – Rihem Akkouche3I/ATLAS Shocks Astronomers With Fuel-Like Methanol Molecule At Extraordinary Levels

[USA HERALD] – There are ordinary space stories, and then there are the stories that make even seasoned observers stop…

By – Samuel LopezWar Abroad, Risk At Home: Why Americans Are Quietly Reviewing Insurance Policies As Global Conflicts Expand

[USA HERALD] – As the United States confronts rising geopolitical tensions and the possibility of military engagement on multiple fronts…

By – Samuel LopezPentagon-Anthropic AI Dispute Explodes Into Federal Lawsuits Over AI Safety Policies

A fierce clash at the crossroads of technology, national security, and free speech has erupted in Washington, as the Pentagon-Anthropic…

By – Rachel MooreG7 Oil Reserve Release Considered as Iran War Disrupts Global Energy Supply

A sudden shock to the world’s oil arteries has pushed major economies toward an emergency response, with a potential G7…

By – Rihem AkkoucheOpenAI Acquires Promptfoo to Strengthen AI Security and Testing Tools

In a strategic move that underscores the intensifying race to secure advanced artificial intelligence systems, OpenAI acquires Promptfoo, a cybersecurity…

By – Rihem AkkoucheWhen The Files Are Finally Unsealed The Most Mind-Bending Truth May Not Be What We Expect

[USA HERALD] – There is a widespread assumption that if governments release their most highly classified files related to unidentified…

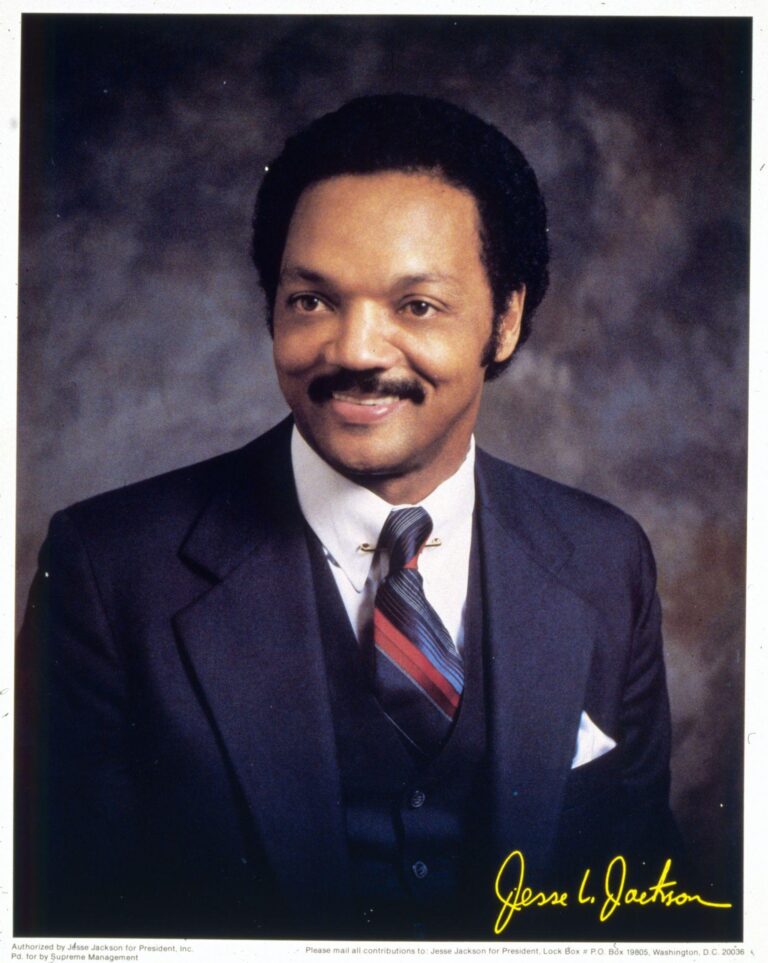

By – Samuel LopezCivil Rights Icon Rev. Jesse Jackson Dies at 84 As President Trump Issues Personal Tribute

[USA HERALD] — The Rev. Jesse Jackson, a towering figure of the American civil rights movement whose career spanned more than…

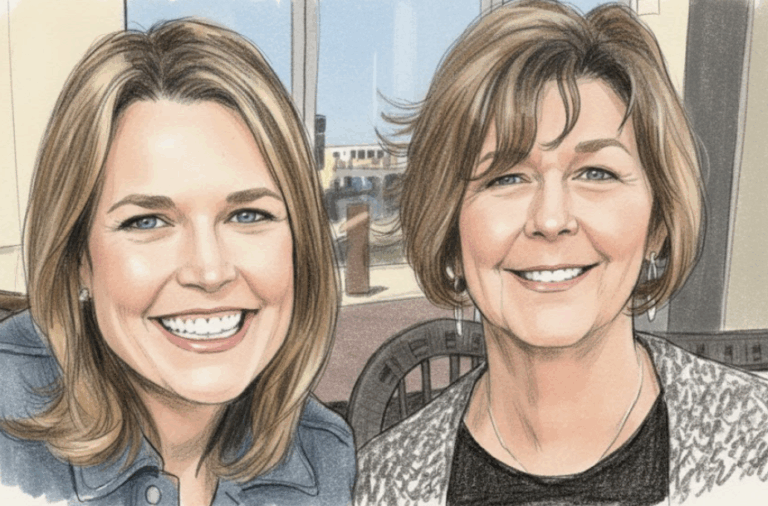

By – Samuel LopezClues to Savannah Guthrie Missing Mom’s Disappearance Found on Security System

The disappearance of the mother of Savannah Guthrie has taken a dramatic turn as investigators focus on digital clues tied…

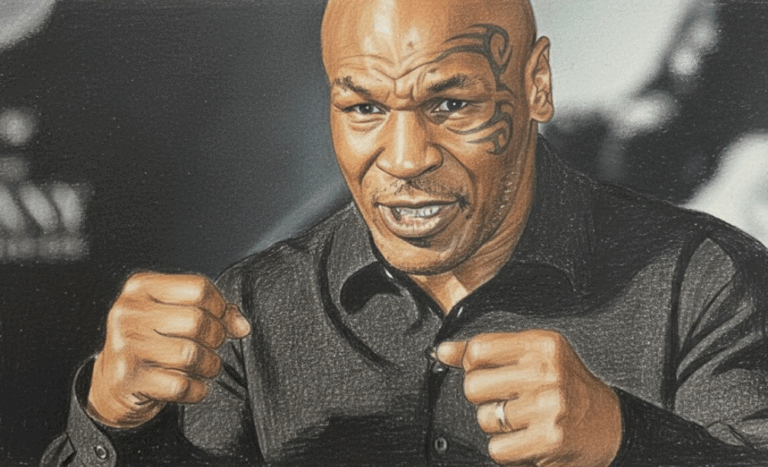

By – Jackie AllenMike Tyson Urges Americans to ‘Eat Real Food’ in Emotional Super Bowl Ad Highlighting Health Risks

Boxing legend Mike Tyson is using his platform ahead of Super Bowl 60 to address a personal and national health…

By – Tyler BrooksDeadly “Death Cap” Mushrooms in California Cause Multiple Deaths and Liver Transplants Amid Rare Super Bloom

California health officials are warning the public after four deaths and three liver transplants linked to the highly toxic death…

By – Ahmed BoughallebFrom Migraines to Miracles: How Becca Valle Survived a Glioblastoma Diagnosis Against the Odds

Becca Valle, 41, thought her headaches were just migraines—until a sudden, unbearable pain revealed something far more serious. In September…

By – Tyler BrooksCadillac Names Inaugural Formula 1 Car MAC-26 in Tribute to Mario Andretti Ahead of 2026 Australian Grand Prix Debut

Cadillac has officially revealed the name of its first Formula 1 challenger, confirming that its 2026 car will be called…

By – Ahmed BoughallebNorway Tops Medal Table After Day 13 at 2026 Winter Olympics as Team USA Surges Into Second Place

With 13 days complete at the 2026 Milan Cortina Winter Olympics, Norway sits atop the overall medal standings, collecting 34…

By – Ahmed BoughallebOlympic Science Explained: How Figure Skaters Spin at Blinding Speeds Without Getting Dizzy

When Amber Glenn finishes her routine, the arena usually rises with her. The music builds, her blades carve a tight…

By – Tyler BrooksOlympic Villages Run Out of Condoms at 2026 Milan-Cortina Games

Condom supplies in the Olympic Villages at the 2026 Winter Games have been temporarily depleted, the Milan-Cortina organizing committee confirmed,…

By – Tyler BrooksArizona Authorities Escalate Search for Savannah Guthrie’s Mom to a Criminal Investigation

In Arizona, police are intensifying their investigation into the disappearance of Nancy Guthrie, Savannah Guthrie’s Mom. The 84-year-old mother of…

By – Jackie AllenWhat is Aegosexuality?

As conversations around sexuality continue to expand, so does the language we use to describe it. Sexuality terms are gaining…

By – Jackie AllenNo posts found.

No posts found.

No comments yet. Be the first to comment!

No comments yet. Be the first to comment!