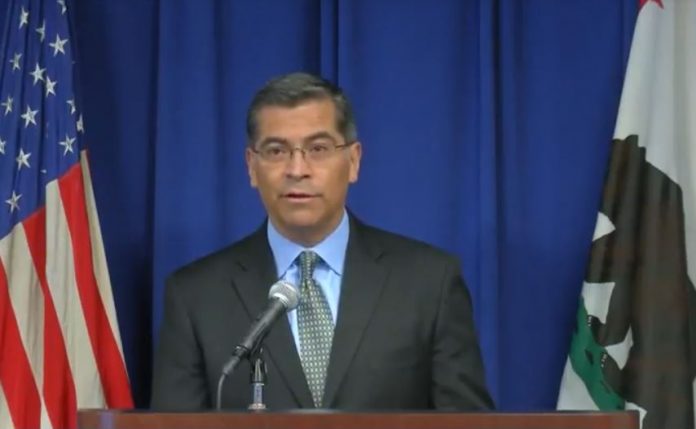

California Attorney General Xavier Becerra is supporting a legislation to fight the growing underground economy in the state.

In a statement, AG Becerra said he is sponsoring Senate Bill 1272, which will make the Tax Recovery and Criminal Enforcement (TRaCE) Task Force permanent. The TRaCE Task Force will operate under the California Department of Justice.

In addition, the legislation will expand TRaCE Task Force with permanent teams in the Bay Area, Fresno, Los Angeles, Sacramento, and San Diego.

The attorney general believes that the bill would provide necessary resources to enforce the law and protect every hardworking Californian.

AG Becerra noted that California is “home to the world’s sixth largest economy.” He stressed that every worker who contributes to the state’s economy “deserves rights at work, every upstanding business deserves a fair market.”

He added, “Every taxpayer deserves to see their hard-earned money used to fund vital services. If you work hard and play by the rules, you should be able to get ahead.