According to experts, the change on the tax rate for pass-through companies is beneficial to small businesses. However, it is also a blessing to law firms, partnerships, and real estate companies including those owned by President Donald Trump.

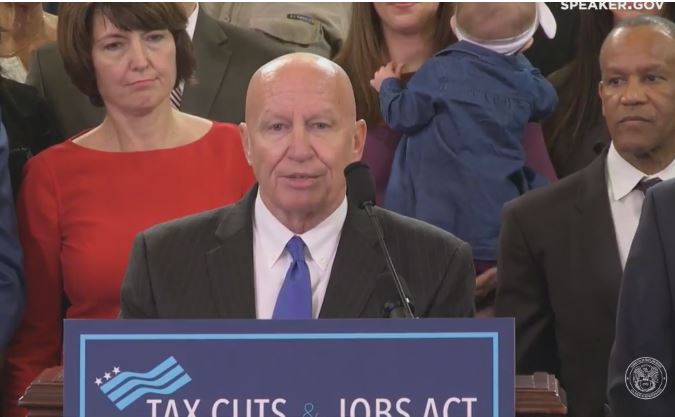

GOP tax plan will likely increase deficit by $1.5 trillion

In a press release, Sen. Feinstein slammed Republicans’ effort to provide big tax cut for large corporations and wealthiest Americans. She also emphasized that the GOP tax plan will likely increase the deficit by $1.5 trillion

Feinstein said, “It’s unbelievable the lengths that Republicans will go to give the richest Americans a huge tax cut. She is “concerned about the limitation on essential tax provisions” beneficial for working families and the middle class.

The senator added that the GOP is lowering “key deductions and credits for families in order to give the richest Americans and large companies a tax cut.” Feinstein is referring to the mortgage interest and state and local tax (SALT) deductions.