According to Vee Daniel of the Better Business Bureau, South Carolina businessman John Monarch’s companies and a number of his clients have received complaints from consumers.

In a strikingly similar pattern, consumers allege they were scammed by a wide variety of diet, skin care, e-Cig, and sleeping aid “free trial” negative options that billed their credit cards for charges up to $500 without their consent.

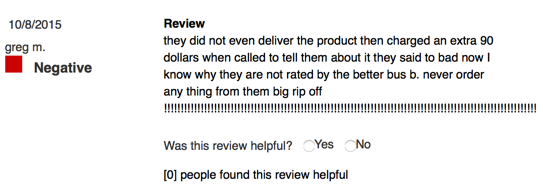

Consumer complaint examples that link back to John Monarch’s Direct Outbound Services:

The FTC considers the phrase “negative option” or “free trial” to broadly refer to a category of commercial transactions in which sellers interpret a customer’s failure to take an affirmative action, either to reject an offer or cancel an agreement, as assent to be charged for goods or services. For a glossary of terms used by free trial merchants, read this article.